Shares of Uber Technologies (UBER) experienced a downturn of approximately 5% during trading yesterday following the announcement of Tesla’s (TSLA) impending Robotaxi launch in Austin on June 12. Despite this fluctuation, Brian Pitz, a leading analyst at BMO Capital, maintains a positive outlook on Uber’s long-term strategy and growth potential. He views the recent slip in share price as an advantageous buying opportunity, reaffirming his Outperform rating along with a $101 price target, branding Uber as a “Top Pick” within the ride-hailing sector.

In his assessment, Pitz believes the market has significantly overreacted to Tesla’s announcement. He highlights that the initial rollout of just 10 to 20 vehicles is modest compared to Uber’s ambitious plans. Notably, Uber’s partnership with Waymo, a subsidiary of Alphabet (GOOGL), will soon introduce hundreds of autonomous vehicles to its platform. Furthermore, Uber is collaborating with May Mobility and China’s WeRide to launch autonomous vehicles across multiple U.S. cities.

BMO has praised Uber’s strategic acquisition of Dantaxi, Denmark’s largest taxi service, which adds 3,500 drivers to its roster. Starting this summer, Danish users will be able to book rides through the Uber app, a move that is expected to enhance user adoption by improving match rates and estimated times of arrival (ETAs). This expansion will also provide additional convenience for airport transfers, leisure activities, and daily commuting.

On the autonomous vehicle front, Pitz identifies Uber as a frontrunner, noting that the company is currently engaged with over 15 AV partners and aims to initiate shared autonomous rides by 2026. This strategy is already translating into increased usage in markets like Austin, where demand remains strong.

BMO Capital views Uber’s current valuation as attractive, with shares priced at 19 times next-twelve-month EBITDA, which is below the two-year forward average of 21 times and well below the upper limit of 27 times. This pricing indicates significant potential for growth, should Uber successfully execute its global and autonomous initiatives.

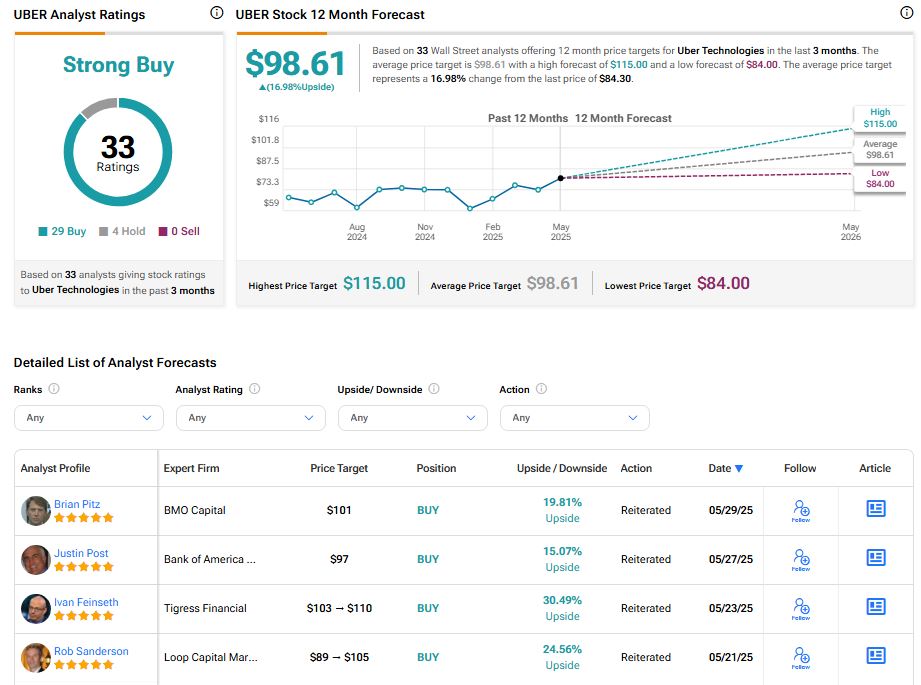

Wall Street’s sentiment towards Uber is predominantly positive, reflected in a Strong Buy consensus rating based on 29 buy recommendations and four hold ratings. The average target price for Uber stock stands at $98.61, suggesting an upside potential of approximately 16.98%.